iedge s reit

SGX-ST Main Board. The funds manager applies an indexing-investment strategy or passive management to track its performance.

S Reit Report Card Here S How Singapore Reits Performed In Fourth Quarter 2019

In terms of sustainability of its yield from my understanding the iedge s-reit leaders index is projected to deliver a growth of 593 and a yield of 543 in 2022 according to bloomberg terminal as at 30 september 2021 and highlighted in rectangular boxes below and as the csop iedge s-reit leaders etf tracks the performance of this index.

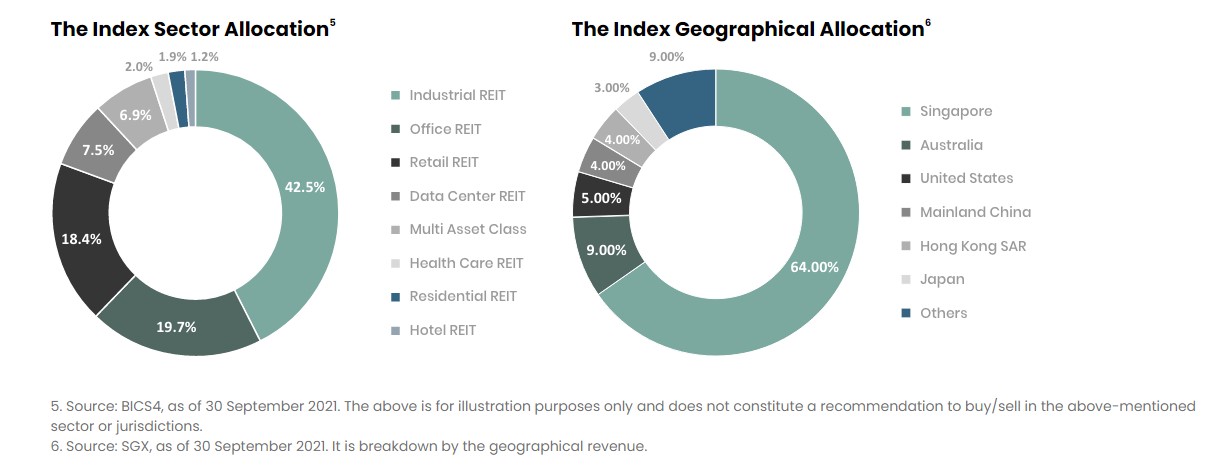

. A real estate investment trust in Singapore S-REIT A fund on SGX that invests in a portfolio of income generating real estate assets such as shopping malls offices or hotels usually with a view to generating income for unit holders of the fund. The index has a weightage cap of 10 per constituent although some holdings may exceed the cap in between rebalancing. It is a market capitalisation weighted index that tracks the performance of the most liquid REITs in Singapore.

After paying its expense ratio of 06 thats about 47. IEdge S-REIT Index - Singapore Exchange SGX We use cookies to ensure that we give you the best experience on our website. Syfe internal backtested data.

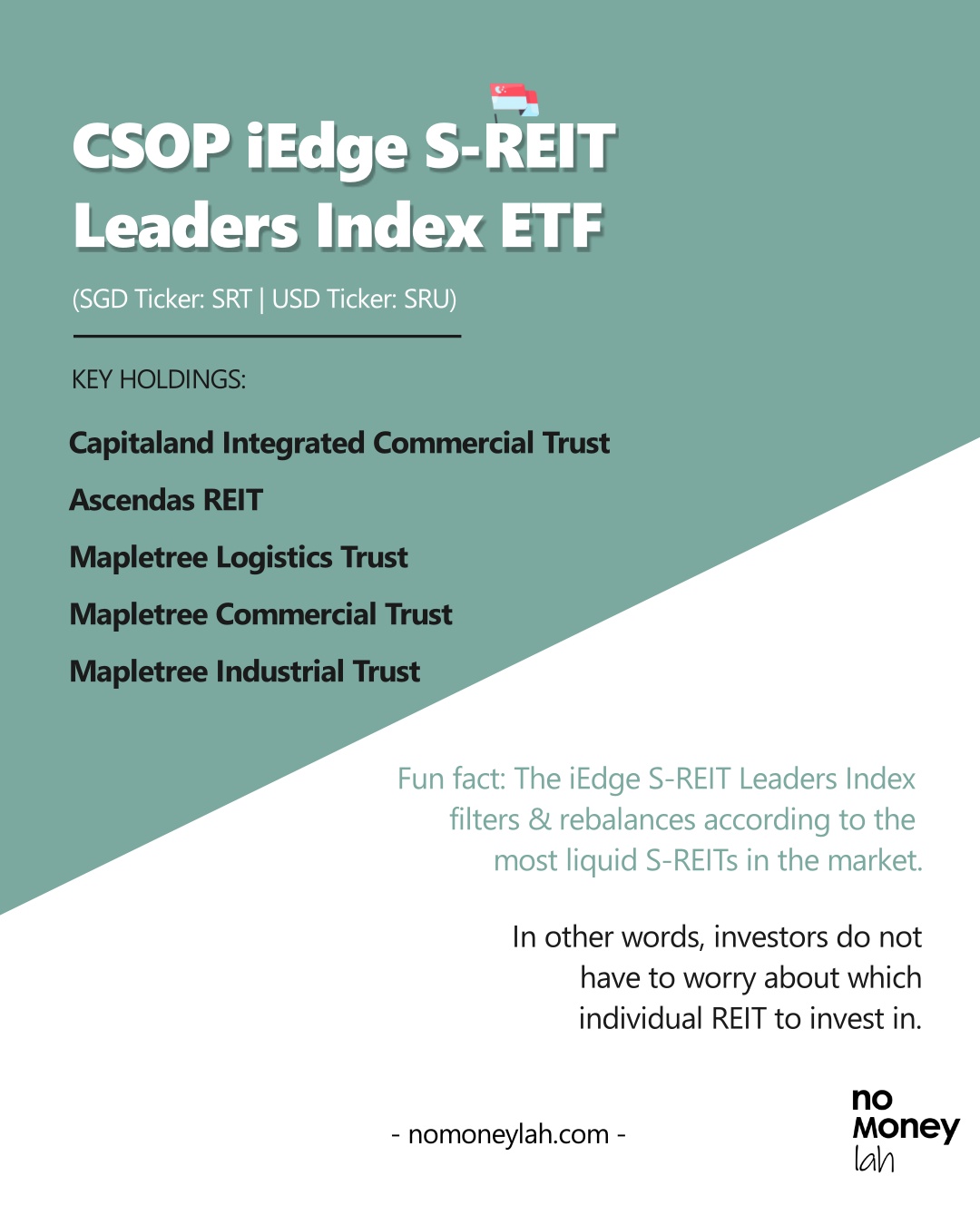

CSOP iEdge SREIT ETF US SRU. The iEdge S-Reit Leaders Index is a narrow tradable adjusted free-float market capitalisation weighted index that measures the performance of the most liquid trusts in Singapore. Lets find out more about this new exchange-traded fund ETF that tracks a real estate investment trust REIT index.

Constituents of the iEdge S-Reit Index. The Index consists of 28 S-REITs one more than the Morningstar Singapore REIT Yield Focus Index which is tracked by the Lion-Phillip S-REIT ETF SGX. IEdge S-REIT Leaders Index.

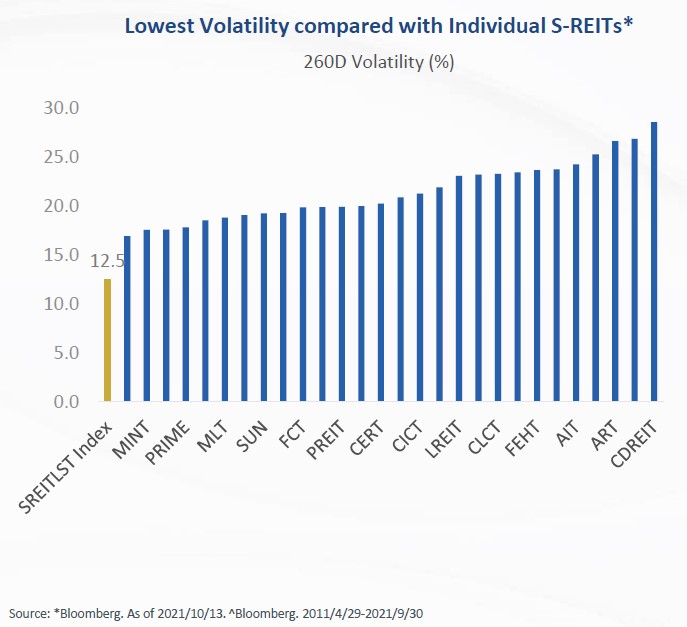

The ETF has several unique characteristics which stand out in particular. IEDGE S-REIT INDEX REIT REIT SGX See more on advanced chart 12958708 D SGD 116420 089 Market Closed as of Jun 10 1929 GMT8 13075128 Prev 13009298 Open NA Volume 12924779 13009298 Days Range Overview News Ideas REIT Chart 1D 5D 1M 3M 6M YTD 1Y 5Y All log Trade REIT with trusted brokers on TradingView Open account Ideas. Business Wire A real estate investment trust in Singapore S-REIT is a fund on SGX that invests in a portfolio of income generating real estate.

Get CSOP iEdge S-REIT Leaders Index ETF CSOP-SGSingapore Exchange real-time stock quotes news price and financial information from CNBC. 6 Correlation Matrix Between SREITs and Other Asset Classes Asia Indices 1 FTSE ST REIT Index 2 iEdge S-REIT Index. Tracks the iEdge S-REIT Leaders Index with all its constituents weights and corporate actions.

Fri Sep 17 2021 - 550 AM. KUALA LUMPUR Sept 13. 10 Units or such other number of Units as the SGX-ST may.

As of 25 Jun 2022 NAV - 09497 Expense Ratio - Nil. The research houses analyst Yap Xiu Li maintained overweight on Malaysian REITs as she believed they still command attractive yields. Trading Board Lot Size.

Find the latest information on iEdge REIT REITSI including data charts related news and more from Yahoo Finance. If you click Accept Cookies or continue without changing your settings you consent to their use. What I dont like about this is.

The fund tracks the performance of the iEdge S-REIT Leaders Index which mostly comprises S-REITs. If we assume dividends are not reinvested the returns would have been 431. Past returns are not a guarantee for future performance.

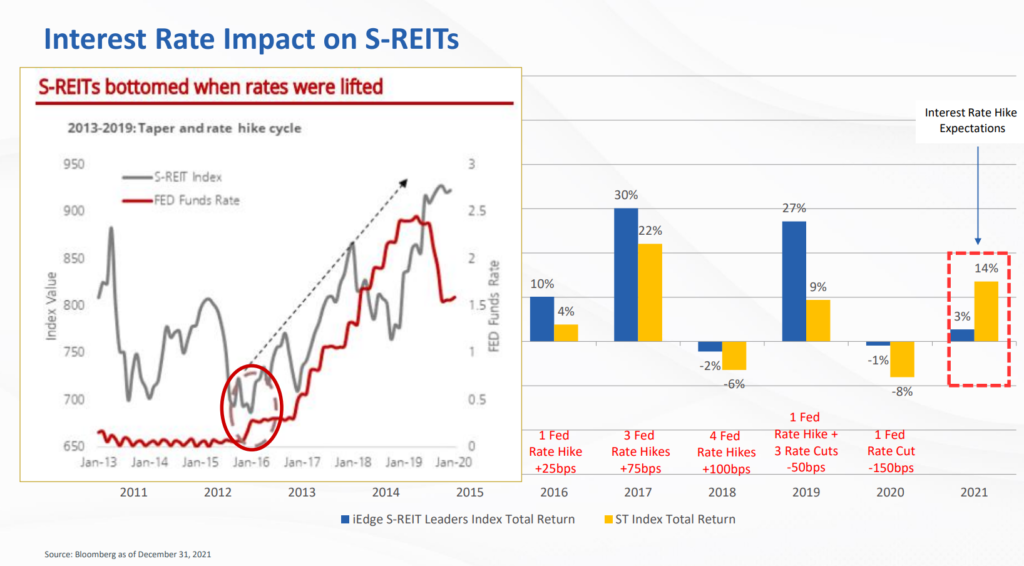

Theres going to be a new kid on the REIT ETF block giving investors another option to invest in Singapore REITs seamlessly. As interest rates continue to be low the real estate investment trusts REITs dividend yields of 5 to 9 from 2022 onwards are attractive and will be sustained by the earnings recovery opines UOB KayHian Research. CSOP iEdge S-REIT Leaders Index ETF Photo.

Get our introductory offer at only. It has delivered an annualised return of 992 in the past 5. The index is rebalanced twice a year in March and September.

Launched in 2014 the iEdge S-REIT Leaders Index is an index established to measure the performance of the largest and most liquid REITs listed in the Singapore Stock Exchange SGX. The Sub-Fund is a passively managed index-tracking ETF with an investment objective of replicating closely the performance of the iEdge S-REIT Leaders Index the Index. The CSOP iEdge S-REIT Leaders Index ETF is a Sub-Fund of the CSOP SG ETF Series I Unit Trust.

SRT - CSOP iEdge S-REIT Leaders ETF Price Holdings Chart more for better stock Trade investing. Based on historical data we can see that its total return of the iEdge S-REIT Leaders Index over the past 5 years is at 950 inclusive of dividends being reinvested. S-REIT News - Read the latest S-REIT breaking news stay updated on business news investment company news stocks S-REIT news only on The Edge Singapore.

CSOP iEdge SREIT ETF S SRT Secondary Currency. Figures indexed at 100 as of Sep 2010 base date of iEdge S-REIT Index Source. The CSOP iEdge S-REIT Leaders Index ETF is a sub-fund of the CSOP SG ETF Series I a Singapore unit trust.

Bloomberg SGX data as of 31 January 2022 Price Return Indices. To ensure that the REITs tracked by the index are the most liquid REITs the iEdge S-REIT Leaders Index employs a liquidity-adjustment strategy. 2013 2014 2016 2018 2020 0 50 100 150 200.

You can change your settings at any time. UPDATED Fri Sep 17 2021 - 550 AM. The iEdge S-REIT Leaders Index isnt new in fact it has been around since 2014.

SGX Counter Name Code. 100 REIT Source. Scheduled system maintenance from 1100AM 25 Jun to 1000AM 26 Jun.

Come towards the end of November CSOP iEdge S-REIT Leaders Index ETF will start trading on the Singapore Exchange SGX. Not too bad for buying a diversified REIT ETF. The suite comprises the iEdge S-Reit index widely regarded as one of S-Reits barometers and a narrower subset of it the iEdge S-Reit Leaders Index.

To learn more about how we collect and use cookies and how you configure. Get detailed information on iEdge S-REIT Index REITSI including stock quotes financial news historical charts company background company fundamentals company financials insider trades annual reports and historical prices in the Company Factsheet. CSOP iEdge S-REIT Leaders Index ETF factsheet Which means this Singapore REIT ETF projects to pay a higher dividend yield of 53.

If you are a subscriber.

Why Singapore Reit Investors Should Consider Investing Via The Iedge S Reit Leaders Index

4 Things About The Csop Iedge S Reit Leaders Index Etf Srt Sru To Know Before Investing

Csop Iedge S Reit Leaders Index Etf What Investors Should Know About This New Reit Etf

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

Csop Iedge S Reit Leaders Index Etf To List On Sgx

Csop Iedge S Reit Leaders Index Etf Poems

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

4 Things About The Csop Iedge S Reit Leaders Index Etf Srt Sru To Know Before Investing

Does Inflation And Rising Interest Rate Affect Reits Featuring Csop Iedge S Reit Leaders Index Etf Edition

Syfe Reit Vs Csop Iedge S Reit Leaders Index Etf Which Reit Investment Should You Choose

Reits Report Card 2021 How Singapore Reits Performed In 2nd Quarter 2021

Constituents Of The Iedge S Reit Index Companies Markets The Business Times

Index Update Sgx S Iedge S Reit 20 Index Will Become The Iedge S Reit Leaders Index

Syfe Reit Vs Csop Iedge S Reit Leaders Index Etf Which Reit Investment Should You Choose

Index Update Sgx S Iedge S Reit 20 Index Will Become The Iedge S Reit Leaders Index

Csop Iedge S Reit Leaders Index Etf What Investors Should Know About This New Reit Etf

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

Syfe Reit Vs Csop Iedge S Reit Leaders Index Etf Which Reit Investment Should You Choose

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

Comments

Post a Comment